In a world where financial markets are increasingly volatile and digital assets dominate headlines, the allure of tangible, enduring investments has never been stronger. Among these, vintage watches stand out as a unique asset class—one that combines artistry, heritage, and the potential for significant financial appreciation. For discerning collectors and savvy investors alike, vintage watches offer not only the pleasure of ownership but also the promise of long-term value. This article explores why vintage watches are gaining traction as investments, what factors drive their value, and how to navigate this fascinating market.

The Allure of Vintage Watches

Vintage watches are more than just timekeepers; they are mechanical marvels, historical artifacts, and wearable works of art. Each piece tells a story—of the era in which it was made, the craftsmen who assembled it, and the individuals who wore it. This rich tapestry of history and craftsmanship infuses vintage watches with a character that modern mass-produced watches often lack.

But beyond their aesthetic and historical appeal, vintage watches have emerged as a compelling investment vehicle. The market for these timepieces has grown exponentially over the past two decades, fueled by a combination of nostalgia, scarcity, and the desire for alternative investments.

Why Invest in Vintage Watches?

1. Tangible Asset in an Intangible World

Unlike stocks, bonds, or cryptocurrencies, vintage watches are physical assets you can hold, wear, and enjoy. This tangibility provides a sense of security and satisfaction that digital investments cannot match. In times of economic uncertainty, tangible assets often retain or even increase in value, making them a prudent hedge against inflation and market downturns.

2. Scarcity and Exclusivity

The value of vintage watches is intrinsically tied to their rarity. Many iconic models were produced in limited quantities, and as time passes, the number of well-preserved examples dwindles. This scarcity drives demand—and prices—higher, especially for watches with unique features, provenance, or historical significance.

3. Proven Track Record of Appreciation

Historical data shows that certain vintage watches have consistently outperformed traditional investments over the long term. For instance, rare Rolex, Patek Philippe, and Audemars Piguet models have seen their values multiply several times over in recent decades. While past performance is no guarantee of future results, the upward trajectory of the vintage watch market is hard to ignore.

4. Emotional and Aesthetic Value

Unlike many investments, vintage watches offer intrinsic enjoyment. Collectors often speak of the joy of wearing a piece of history, the thrill of the hunt, and the satisfaction of curating a collection. This emotional connection can make the investment journey more rewarding—and less susceptible to panic selling during market fluctuations.

5. Portfolio Diversification

Adding vintage watches to your investment portfolio can provide diversification, reducing overall risk. Because the vintage watch market is influenced by different factors than stocks or real estate, it can act as a buffer during periods of financial turbulence.

Understanding the Vintage Watch Market

Before diving into the world of vintage watch investment, it’s essential to understand the market’s unique dynamics. Unlike commodities or equities, the value of a vintage watch is determined by a complex interplay of factors, including brand, model, condition, provenance, and market trends.

Key Factors Influencing Value

When assessing the investment potential of a timepiece, several key factors come into play.

Brand and model are paramount—certain names like Rolex, Patek Philippe, Audemars Piguet, and Jaeger-LeCoultre have long stood as blue-chip assets in the watch world. Iconic models such as the Rolex Daytona and Patek Philippe Nautilus consistently command premium prices, driven by their heritage, craftsmanship, and enduring demand.

Rarity and production numbers also play a decisive role; limited runs, discontinued editions, or watches featuring unusual dial colors or complex complications are highly coveted for their scarcity and collectability.

Equally crucial is condition and originality—pieces that retain unpolished cases, original dials, and all matching parts are valued far above those that have been restored or altered. Original boxes, papers, and service documentation can further elevate a watch’s desirability.

Provenance adds another layer of allure: watches once owned by celebrities, featured in films, or linked to historical events often achieve extraordinary auction results, their stories enhancing their material worth.

Finally, market trends shape the landscape—tastes evolve, and models move in and out of fashion, making awareness of current collector sentiment essential for sound investment choices.

How to Start Investing in Vintage Watches

1. Educate Yourself

Knowledge is your most valuable asset. Begin by immersing yourself in the world of vintage watches—read books, follow reputable blogs, and participate in forums. Resources like our Education section offer a wealth of information for both beginners and seasoned collectors.

2. Define Your Investment Strategy

Are you looking for long-term appreciation, short-term gains, or a combination of both? Do you prefer to focus on a single brand or diversify across multiple marques? Clarifying your goals will help guide your acquisition strategy.

3. Set a Budget

Vintage watches span a wide price range, from a few hundred dollars to several million. Determine how much you’re willing to invest and stick to your budget. Remember to factor in ancillary costs such as insurance, servicing, and storage.

4. Buy the Best You Can Afford

Quality trumps quantity in the vintage watch market. It’s better to own one exceptional piece than several mediocre ones. Focus on watches in excellent condition, such as those from prestigious brands like Jaeger-LeCoultre, with original parts and documentation whenever possible.

5. Work with Reputable Dealers

The vintage watch market is rife with counterfeits and misrepresented pieces. Partnering with trusted dealers, who offering investment advisory services, can help you navigate the market with confidence.

6. Authenticate and Appraise

Before making a purchase, have the watch authenticated and appraised by an expert. This step is crucial for ensuring you’re getting what you pay for and protecting your investment.

7. Maintain and Insure Your Collection

Proper maintenance is essential for preserving value. Regular servicing by qualified watchmakers, careful storage, and comprehensive insurance coverage will safeguard your investment for years to come.

Case Studies: Iconic Vintage Watches as Investments

To illustrate the investment potential of vintage watches, let’s examine a few notable examples:

Rolex Daytona “Paul Newman”

Once a niche variant of the Daytona line, the “Paul Newman” exotic-dial Daytona has become one of the most coveted vintage watches in the world. In 2017, the example owned by Paul Newman himself sold at auction for about 17.75 million USD. When these watches first appeared, similar exotic-dial Daytonas were selling for just a few hundred dollars. Today, well-preserved examples without celebrity provenance regularly reach hundreds of thousands, while the rarest pieces command several million. This model perfectly demonstrates how rarity, provenance, and cultural significance can make an impact on the price.

Patek Philippe Nautilus Ref. 3700/1 (“Jumbo”)

The original Nautilus, launched in 1976 and designed by Gérald Genta, features a distinctive porthole case and integrated bracelet. Initially retailing for around 4,000 USD, it was considered expensive for a steel watch. Over the decades, it has become a symbol of refined luxury, with pristine examples now often exceeding 200,000 USD and in some cases reaching more than 250,000 USD. The Nautilus illustrates how strong design identity and brand prestige can turn an unconventional idea into an investment-grade icon.

Audemars Piguet Royal Oak Ref. 5402

Introduced in 1972 and also designed by Gérald Genta, the Royal Oak redefined the luxury sports watch with its octagonal bezel and exposed screws. At launch, it cost roughly 3,000–4,000 USD—astonishing for a steel watch at the time. Today, early “A-series” examples often sell for between 100,000 and 200,000 USD, with exceptional pieces going higher. The Royal Oak’s success underscores how innovation, limited production, and enduring design can yield exceptional long-term value.

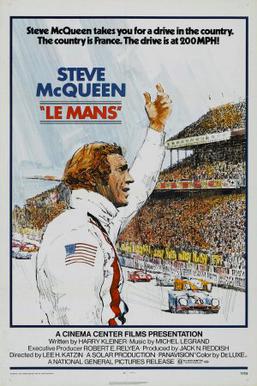

Heuer Monaco Ref. 1133 (“Steve McQueen”)

The Heuer Monaco became legendary after Steve McQueen wore it in the 1971 film Le Mans. Once a quirky square chronograph, it has transformed into a blue-chip collectible. Original 1970s examples in excellent condition typically command high five-figure prices, while watches with confirmed McQueen provenance have fetched between 1.4 and 2.2 million USD at auction. The Monaco demonstrates the power of pop-culture associations in elevating a watch from curiosity to icon.

Risks and Challenges

While the potential rewards are significant, investing in vintage watches is not without risks. Understanding these challenges is essential for making informed decisions.

1. Market Volatility

Like any asset class, the vintage watch market is subject to cycles of boom and bust. Prices can be influenced by macroeconomic factors, changing tastes, and speculative bubbles.

2. Counterfeits and Frankenwatches

The prevalence of counterfeit and “Frankenwatches” (watches assembled from mismatched parts) poses a significant risk. Even experienced collectors can be deceived, underscoring the importance of authentication and due diligence.

3. Liquidity Constraints

While the market for top-tier vintage watches is robust, selling lesser-known models can be challenging. It may take time to find a buyer willing to pay your asking price.

4. Maintenance Costs

Vintage watches require regular servicing to remain in optimal condition. These costs can add up over time, especially for complicated or rare models.

5. Changing Trends

What’s hot today may not be tomorrow. Staying attuned to market trends and collector preferences is crucial for maximizing returns.

Key Considerations for Vintage Watch Investors

| Consideration | Importance | Notes |

|---|---|---|

| Authenticity | Critical | Always verify with experts before purchase |

| Condition | High | Original, unpolished, with matching parts preferred |

| Provenance | High | Documented history adds value |

| Brand/Model | High | Focus on established, desirable brands and references |

| Market Trends | Medium | Stay informed to anticipate shifts in demand |

| Maintenance | Medium | Factor in ongoing servicing and insurance |

The Role of Professional Guidance

Given the complexities of the vintage watch market, many investors choose to work with professionals. Expert advisors can assist with sourcing, authentication, valuation, and portfolio management. Services like our professional investment advisory provide tailored guidance to help you build a collection that aligns with your financial goals and personal tastes.

The Future of Vintage Watch Investing

The vintage watch market shows no signs of slowing down. As new generations discover the charm and value of mechanical timepieces, demand continues to grow. The rise of online marketplaces and global auctions has made it easier than ever to buy, sell, and research vintage watches, further fueling market expansion.

Moreover, the increasing digitization of the world has only heightened the appeal of analog craftsmanship. In an age of disposable technology, vintage watches represent permanence, tradition, and artistry—a counterpoint to the ephemeral nature of modern life.

Timeless Value

Investing in vintage watches is about more than financial gain; it’s about passion, history, and the pursuit of excellence. By educating yourself, working with trusted professionals, and focusing on quality, you can build a collection that not only appreciates in value but also enriches your life.

Whether you’re a seasoned collector or a newcomer to the world of horology, vintage watches offer a timeless opportunity—one that transcends trends and endures through generations. For those ready to embark on this journey, resources like our Vintage Watches Collection and Education section are invaluable starting points. And for those seeking expert guidance, we would be pleased to provide an investment advisory services to navigate this rewarding market with confidence.

A vintage watch is more than an investment—it’s a legacy, a statement, and a celebration of the artistry of time.